ASC 842 – What to Do Now That It’s in Effect

What do US private companies need to know about ASC 842?

It’s July 2022 which means that the Financial Accounting Standards Board’s Accounting Standards Codification 842, also known as ASC 842, has officially come into play for US private companies. ASC 842 changes the way companies account and report their lease obligations whether they are a lessee or lessor. It brings all leases onto private company balance sheets by creating right of use (ROU) assets and liabilities. This means, operating leases will now be on the balance sheet, and capital leases become finance leases. The main takeaway from this standard coming into effect is understanding the impact on regular operations.

What should companies do if they haven’t implemented ASC 842 yet?

The first step is understanding all your leases. A fleet of vehicles, heavy equipment, global offices with a different lease for each copier – it all adds up. And it’s not just about the initial adoption of the new standard; it’s also about the ongoing process of maintaining compliance. The accounting department needs to have a seat at the table and be in the know when it comes to negotiations and executions to avoid being behind amortizing leases. It’s also important to have a clear idea as to what constitutes a lease. Some contracts for IT data management, cloud services, transportation, and advertising can have lease connotations somewhere in the fine print.

The second step is recognizing the effect to financial statements that implementing lease accounting will have and ensuring that all interested parties are well informed. A 10-year office lease can be a large liability and would require the proper explanation to board members and audit committees. It is beneficial to have all your leases in one place so that your organization can analyze their impact better.

When you should you adopt a Lease Accounting Solution?

Depending on your organization, you might have a small number of leases and so you might be able to handle implementing ASC 842 on your own and perform your lease accounting using spreadsheets and adopting a “business-as-usual” stance. However, as we’ve seen over the past couple of years, spreadsheets are not agile enough to handle the pace of change that is the new “business-as-usual.” From executives to lower-level finance team members, everybody expects the information they need immediately. Legacy applications are too slow.

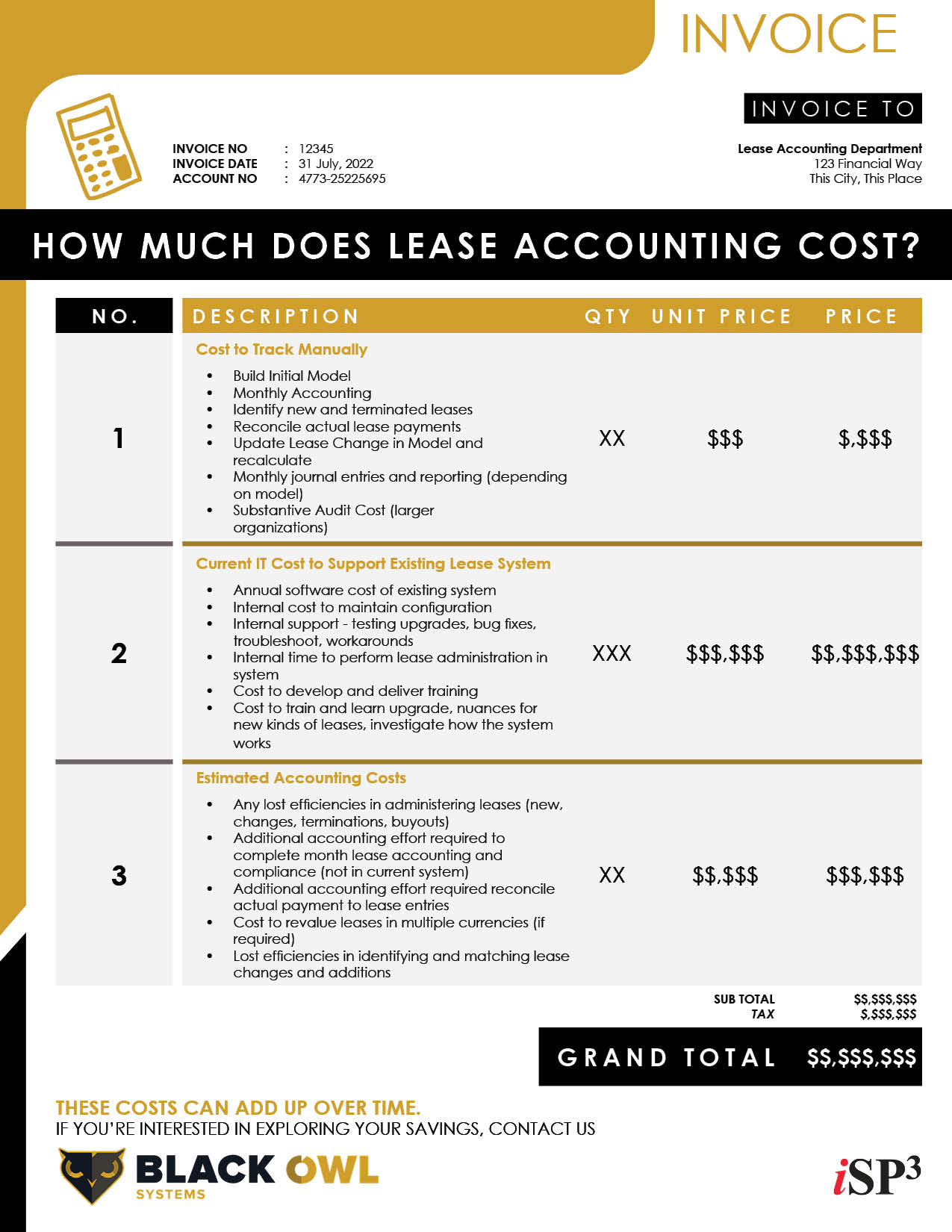

How much should you be spending on Lease Accounting?

Sadly, there isn’t one specific answer. There are too many variables across industries. It’s not just about monetary cost; there is the time and effort to manage leases on your financial sheets monthly and annually. Use the following chart to estimate for your own company how much lease accounting is currently costing and where savings could be found.

We Can Help

If your current ERP doesn't have sufficient leasing capabilities, we can help you migrate to a much more robust lease accounting solution, like Black Owl Systems. If you are interested in learning more, please contact us.

Comments are closed.